Investing in a Recession: A Look at the Top Performing Asset Classes During Market Crashes From 2018-2022

Agricultural commodities and fine art performed exceptionally well, while residential real estate, gold, whiskey, farmland, and wine also produced positive returns.

Updated May 27, 2022

Many companies on MoneyMade advertise with us. Opinions are our own, but compensation and in-depth research determine where and how companies may appear.

Farmland

Real Estate

Sports Cards

Wine

Art

Crypto

It may seem like the sky is falling in on investors lately. However, if you look beyond the world of traditional investing, you'll find that some asset classes are actually performing quite well amidst recent market crashes.

Across all three stock market crashes we examined between 2018 and 2022, agricultural commodities and fine art came out as the top performing assets overall.

The burning question of what to do with your investments during a recession is timeless, but the answers to this question have changed dramatically over time. While shifting your asset allocation away from stocks used to mean moving into bonds, gold, or cash, this list of alternative investment options has grown exponentially in recent years. Not only have assets like fine art, wine, farmland, and even residential property become more accessible to everyday investors, but brand new assets have been created, like cryptocurrency and NFTs.

Investors currently have the ability to diversify their portfolios to a greater degree than ever before—but understanding how these alternative assets function during times of economic distress is crucial to reaping the full diversification benefits they offer.

In this study, we examine the performance of 12 different asset classes against the S&P 500 during three recent market crashes:

- January 2022 through May 2022

- February 2020 through April 2020

- September 2018 through December 2018

Only one of these (the 2020 crash at the start of the COVID-19 pandemic) was officially declared a recession. However, the other two market crashes were also significant. Together, these three time periods represent the most severe market crashes (as measured by the S&P 500) over the last five years. Below you'll find the biggest gainers during each market crash, as well as the overall top performing asset classes across all three crashes.

Key highlights

Key highlights

- Agricultural commodities and fine art came out on top overall, both averaging returns of over 7% across the three most recent market crashes, during which the S&P 500 returned an average of -17%.

- Residential real estate, gold, whisky, farmland, and wine all offered moderate positive returns across these market crashes.

- Bitcoin was the worst-performing asset overall, declining more dramatically than the stock market during all three downturns.

- Oil saw the most volatility across these market crashes, offering positive returns of 37% during one while losing over 30% during the other two.

- Sports cards and bonds provided the most stable store of value across all three market crashes, with sports cards slightly outperforming bonds as a safe haven.

Data sources on alternative assets

Data sources on alternative assets

Data on many of these alternative assets is fairly new, so there's a lack of information when it comes to how they perform during a recession. We're partnered with some of the world's most credible data sources across every asset class, and we used this data to provide timely insights into the question of what to invest in during a recession. This data is publicly available on our asset pages linked below, and you can access the full range of data by signing up to become a MoneyMade member for free.

Asset | Index used |

|---|---|

S&P GSCI Agriculture | |

Artprice Contemporary Art Index | |

S&P/Case-Shiller U.S. National Home Price Index | |

iShares Gold Trust (IAU) | |

Rare Whisky Apex 1000 | |

NCREIF Farmland Index | |

Liv-ex 1000 | |

PWCC 500 | |

Abrdn Physical Platinum Shares ETF (PPLT) | |

Invesco DB Oil Fund (DBO) | |

Bitcoin (BTC) | |

S&P 500 (SPX) | |

iShares 7-10 Year Treasury Bond ETF (IEF) |

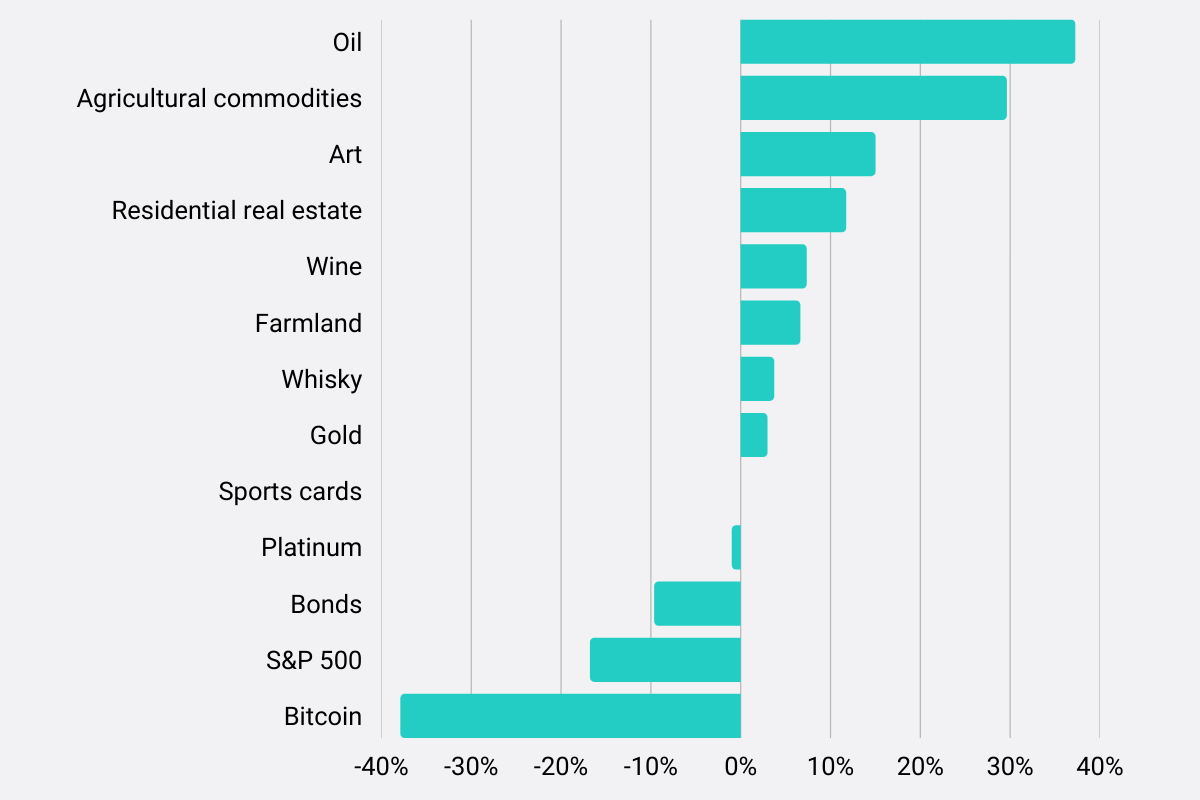

Biggest gainers during the current market crash (January 2022 through May 2022)

Biggest gainers during the current market crash (January 2022 through May 2022)

The National Bureau of Economic Research (NBER) has yet to announce any business cycle dating for 2021 and 2022 or declare another recession, as these are typically announced retroactively.

That said, markets have been falling all year. The current stock market downturn began in January 2022, and talk of an impending recession began to gain steam by March. The S&P 500 is down by over 17% as of May 24th, 2022, and crypto is hurting even more (with Bitcoin down 38%).

Despite the overall abysmal market performance and negative market sentiment, a number of alternative assets are actually fairing quite well during the first half of 2022. The top performers so far have been oil (+37% YTD as of late May), agricultural commodities (+30%), and art (+15%). These leaders were followed by residential real estate (+11.68%), investment-grade wine (+7.29%), and farmland (+6.58%). Finally, gold (+2.92%) and whisky (+3.67%) also offered moderate returns, while sports cards (0%) and platinum (-0.93%) remained stable.

Some of these are unsurprising. Thanks to inflation and the Russian invasion of Ukraine, the prices of both oil and commodities have been skyrocketing all year. Oil came out as the top performer during this downturn, but zooming in on individual agricultural commodities may reveal an even bigger winner. The Teucrium Agricultural Fund (TAGS)—a diversified agricultural commodities ETF that offers exposure to corn, soybeans, wheat, and sugarcane—was up 30% YTD as of late May 2022. Their individual commodity fund CORN, which invests in corn futures, was up 34%, and their WEAT fund, which invests in wheat futures, was up an astounding 56%.

What may be more surprising are the exceptional gains in the fine art market, as measured by the Artprice Contemporary Art Index, making it the 3rd best performing asset class of 2022 thus far. This makes more sense when you consider the fact that on top of being a resilient (recession-resistant) asset, fine art has also been inversely correlated with the stock market in recent years.

Another interesting finding is that sports cards have perfectly retained their value during this current downturn. While gold has long been considered a stable store of value, it's not until recent years that people have begun considering that sports cards could serve a similar purpose. Not only has the PWCC 500 index maintained its value all year, but it significantly outperformed both cash and bonds, both of which are rapidly losing value in recent months.

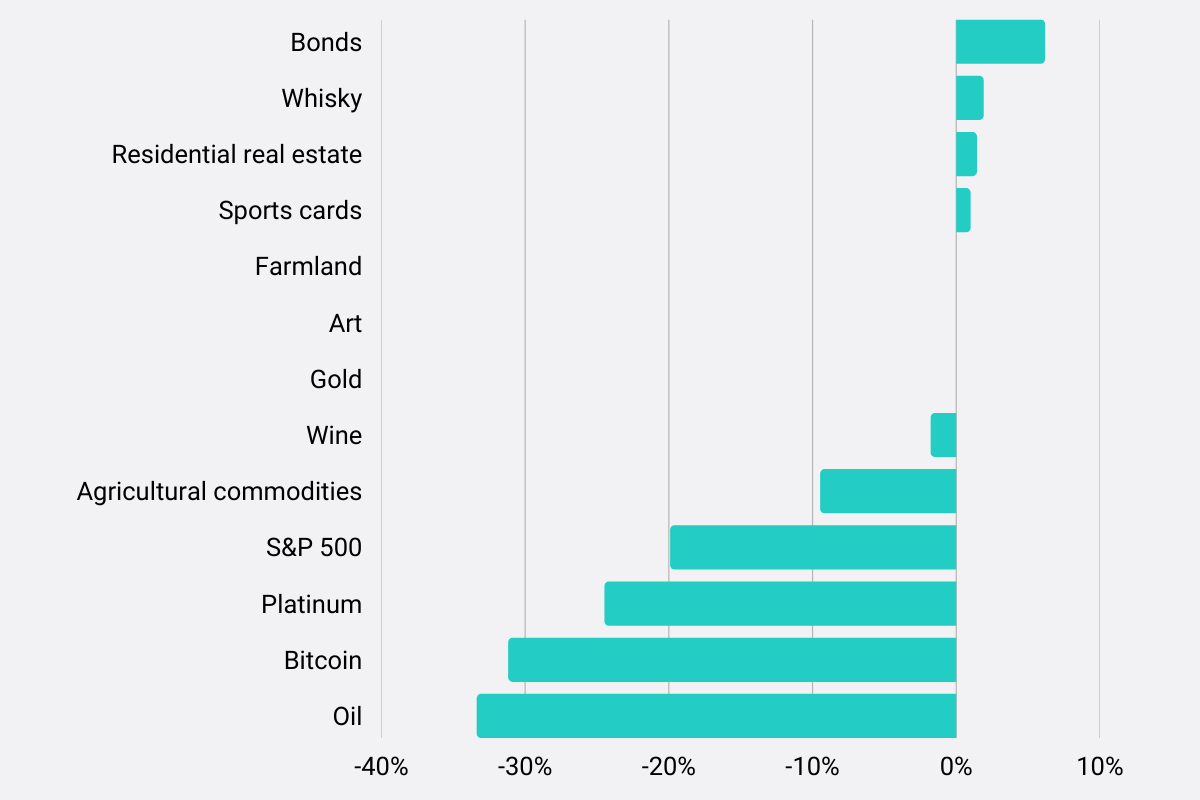

Biggest gainers during the 2020 COVID-19 recession (February 2020 through April 2020)

Biggest gainers during the 2020 COVID-19 recession (February 2020 through April 2020)

The COVID-19 recession lasted just two months, from February 2020 to April 2020, making it the shortest US recession on record according to NBER. That said, the S&P 500 fell sharply—a whopping 19.87%—during that period. Almost every asset went down along with it, including alternatives like Bitcoin (-31%), platinum (-24%), and oil (-33%). Agricultural commodities faired poorly as well.

The only asset that performed well during this period was 7-10 year Treasury bonds, which saw a 6.14% increase over the course of just a couple months. The 2020 recession was unique in that it coincided with a global pandemic that all but shut down nearly every sector of the economy, so it makes sense that even assets that typically aren't correlated with the stock market took a hit.

That said, some alternatives did remain stable or offer small returns during this time period, an impressive achievement amidst global shutdowns. Despite art auctions being put on hold indefinitely at the start of the pandemic, fine art managed to remain relatively stable. And even though demand for agricultural commodities took a big hit, to the point where farmers were tossing millions of pounds of produce and dairy, farmland also remained stable, as did gold.

Investment-grade whisky, residential real estate, and sports cards all offered slight growth, displaying resiliency against both an economic recession and a global pandemic. Sports cards took off shortly after April 2020, during quarantine, and ended up returning an astounding 48% in 2020. (It didn't stop there—sports cards returned 86% in 2021.)

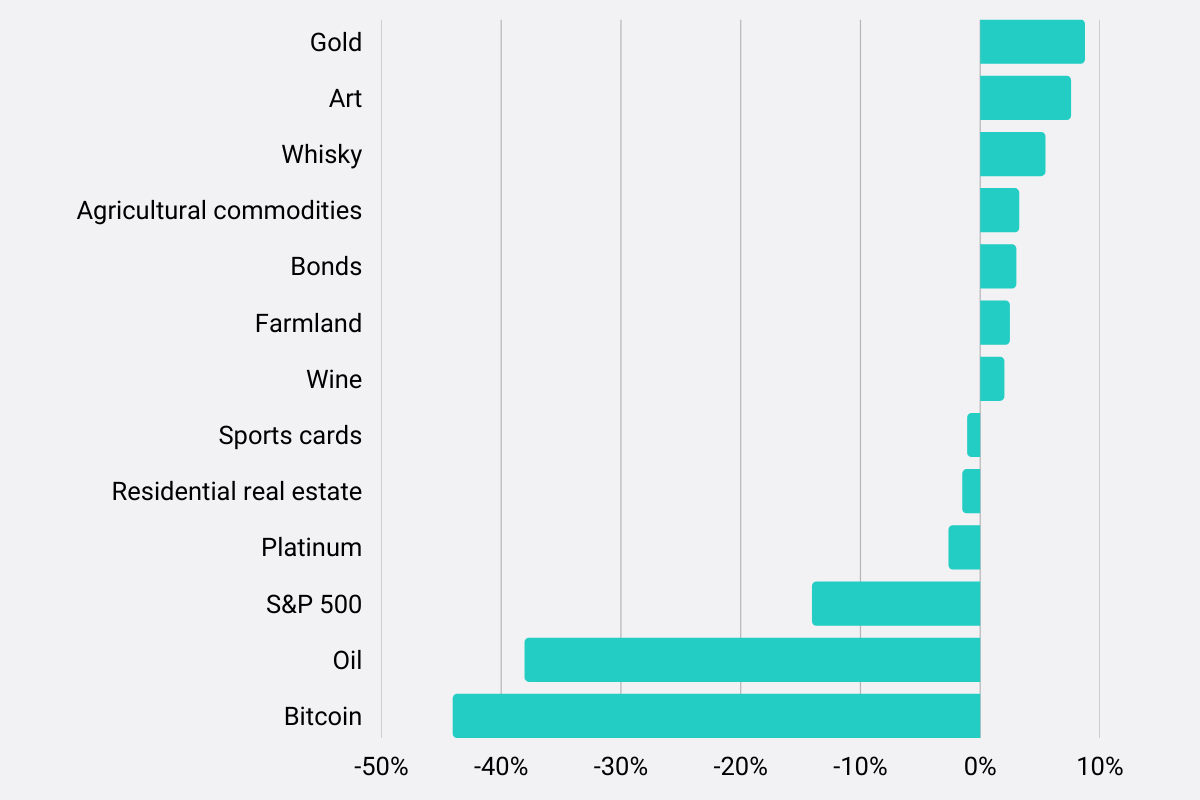

Biggest gainers during the Q4 2018 market crash

Biggest gainers during the Q4 2018 market crash

The economy saw a significant downturn—though not a recession—during Q4 of 2018. From September to December 2018, the S&P 500 returned -14%. Schroders even called it "among the worst 20 quarters of the past half century." Overall, the S&P ended 2018 at a loss even though it had been on the rise for the first three quarters of the year. Luckily for some investors, a handful of alternatives saw decent gains during this same period.

Gold topped the list, generating returns of +8.70% in just a few months. Despite falling throughout the first three quarters of 2018, gold prices began to rebound in September 2018 just as stocks started to fall—the two assets held a near perfect inverse correlation in 2018.

Fine art (+7.54%) came in at a close second, followed by investment-grade whisky (+5.40%). These two assets, along with investment-grade wine (which produced admirable returns of +1.97% during Q4), all fall under the category of luxury collectibles, which generally prove fairly resilient to economic downturns.

Bonds, perhaps unsurprisingly given their inverse correlation with stocks, produced decent returns. Both agricultural commodities and farmland also did fairly well. Sports cards, residential real estate, and platinum all took very minor hits compared to stocks.

The biggest losers during this time period were Bitcoin and oil, crashing significantly harder than the S&P 500. Crude oil prices went through a surprising crash during Q4 after hitting four-year highs. The commodity's prices faced a double whammy in 2018: a sharp increase in supply right as a market downturn caused a decrease in demand. Bitcoin had a particularly bad year as well, returning -73% in 2018—one of only two negative years for the cryptocurrency since its inception.

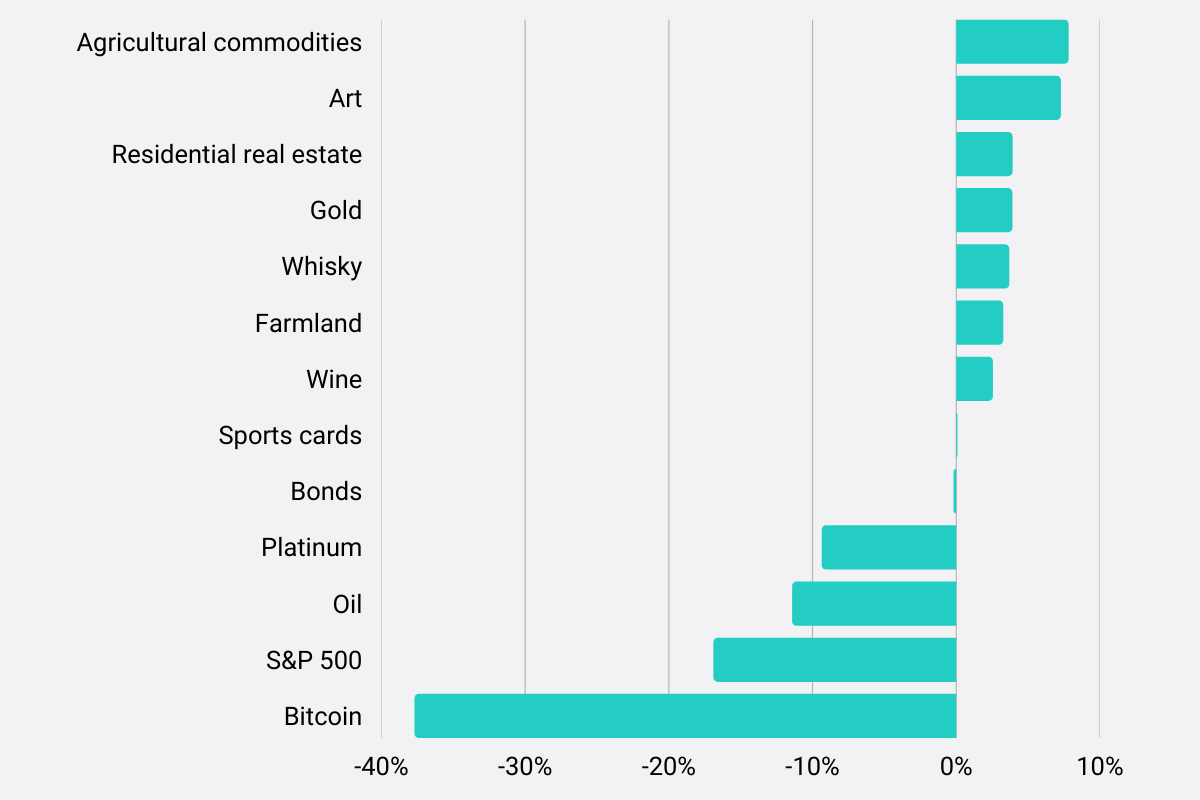

Overall top performing assets during recent market crashes

Overall top performing assets during recent market crashes

These numbers represent each asset class's returns as averaged across the three market crashes covered above.

Across all three stock market crashes we examined between 2018 and 2022, agricultural commodities and fine art came out as the top performing assets overall, followed by gold, whisky, farmland, and wine. Sports cards and bonds both remained stable. Platinum and oil took hits but still outperformed the S&P 500, while Bitcoin tanked even worse than the stock market during all three downturns.

Our study on correlated and uncorrelated assets showed that many of the alternatives mentioned here held a moderate to high correlation with the stock market between the years of 2018 to 2021, meaning they follow similar patterns. Several assets were lower in correlation, suggesting they move somewhat independently of the stock market, and a couple of assets held an inverse correlation with the stock market, meaning they move in opposite directions. However, this correlation doesn't always hold during market crashes, because there are always other factors at play. We describe some of these factors for key asset classes below.

Commodities and farmland during recent market dips

While agricultural commodities and farmland follow similar patterns in response to supply and demand, the two assets function quite differently as investment vehicles, particularly when it comes to liquidity.

Investors typically invest in agricultural commodities by way of agricultural ETFs and stocks, which are publicly traded and highly liquid. We used the S&P GSCI, a major investable commodity index, to measure performance of this asset. Both this and popular agriculture ETFs performed very well during market downturns.

When it comes to investing in farmland, however, we looked at the NCREIF Farmland Index. This index measures the performance of a large pool of individual farmland properties and is therefore more reflective of investing directly in farmland, either by purchasing farmland or investing in an already operating farm through investing platforms like Acretrader and FarmTogether. Unlike agricultural commodities, farmland is a highly illiquid asset. It tends to provide very stable, moderate long-term returns, whereas the price of agricultural commodities tends to be much more sensitive to current events.

While the stability of farmland helped it come out on top in all three recent market crashes, the volatility of agricultural commodities produced far more variance (from -9.43% to 29.57%) but ultimately put it ahead of all other asset classes in this study. Crude oil also showed high variance during market downturns, with returns ranging from -38% to 37%, making it the most volatile asset included in this study. While this volatility is serving investors well during the first half of 2022, it proved extremely unfavorable for investors during the other two recent market crashes.

Higher risk can lead to higher reward or bigger losses, as evidenced by the performance of agricultural commodities and oil in this study. Investors who predicted the price changes in these assets accurately may be able to use these assets—either by investing in ETFs or with platforms like EnergyFunders—to cancel out stock market losses in their portfolios. That said, farmland's lack of volatility helped it serve as a solid asset for mitigating risk without sacrificing too much growth during a downturn.

EnergyFunders

Oil

Fine art and collectibles during recent market dips

This study looked at the Artprice Contemporary Art Index, which includes a basket of blue-chip art created by artists born after 1945. This includes stars like painter Jean-Michel Basquiat, street artist Banksy, painter and sculptor Yoshitomo Nara, and NFT artist Beeple as well as lesser-known names. The contemporary art market tends to outperform other segments within fine art, returning an average of 7.5% per year as compared to the overall art market's 5.3%.

Our correlation study found that both art and bonds were inversely correlated with stocks in recent years, which helps explain why fine art did so well during these market crashes. In fact, all three luxury collectibles included in this study (art, wine, and whisky) came out ahead, suggesting that the market for these assets (the ultra-wealthy) is less impacted by market crashes than other types of investors. This has held true even given the proliferation of new investing platforms like Masterworks and Vinovest that make investing in luxury collectibles more accessible.

Masterworks

4.7

•

Art

Vinovest

4.6

•

Wine

Even sports cards did well, holding a stable value throughout all three downturns. In fact, sports cards proved to be a better store of value than both bonds and cash, the "safe haven" assets investors tend to flock to during times of economic crisis.

Real estate during recent market dips

Interestingly, while REITs came out as the most highly correlated asset in our correlation study, residential real estate (as measured by the US national home price index) tended to offer positive returns in the face of a stock market crash.

This supports the argument many investment experts have made that while public REITs do offer real estate exposure, the fact that they're traded on public markets makes them more likely to follow the same patterns as the stock market. People who invest directly in residential real estate real estate, therefore, experienced far greater diversification benefits during the last three market crashes than REIT investors.

Bonds during recent market dips

Bonds and stocks are typically inversely correlated. When the market starts to fall, investors flock to the safety of bonds. What's more, interest rates typically decline during a recession, which magnifies this demand for bonds even more. This is what we saw in March 2020 when market pessimism paired with rock-bottom interest rates caused Treasury bonds to outperform every other asset.

However, the first half of 2022 told a different story. Due to high inflation and the expectation that the Fed will raise interest rates several times before the end of the year, Treasury bond ETFs fell in price along with the S&P 500. Bond prices have a strong inverse relationship with interest rates that can factor in even more heavily than their inverse relationship to the stock market.

Crypto during recent market dips

In all three market crashes, the crypto market fell even more dramatically than stocks. While analysts initially believed cryptocurrency would be uncorrelated to the stock market, recent years suggest otherwise. Now that crypto is fairly mainstream and far easier to trade, it appears that bigger crypto coins like Bitcoin and stocks are, in fact, highly correlated. However, this may not be the case for some altcoins.

Sources

Sources

- NYSE. S&P 500 (SPX). Retrieved May 25, 2022 from MoneyMade.

- NYSE. Invesco DB Oil Fund (DBO). Retrieved May 25, 2022 from MoneyMade.

- Liv-ex. Liv-ex 1000. Retrieved May 25, 2022 from MoneyMade.

- PWCC. PWCC 500. Retrieved May 25, 2022 from MoneyMade.

- Artprice. Artprice Contemporary Art Index. Retrieved May 25, 2022 from MoneyMade.

- S&P Global. S&P/Case-Shiller U.S. National Home Price Index. Retrieved May 25, 2022 from MoneyMade.

- Rare Whisky 101. Rare Whisky Apex 1000. Retrieved May 25, 2022 from MoneyMade.

- NCREIF. NCREIF Farmland Index. Retrieved May 25, 2022 from MoneyMade.

- NYSE. iShares Gold Trust (IAU). Retrieved May 25, 2022 from MoneyMade.

- NYSE. iShares 7-10 Year Treasury Bond ETF (IEF). Retrieved May 25, 2022 from MoneyMade.

- Binance. Bitcoin (BTC). Retrieved May 25, 2022 from MoneyMade.

- S&P Global. S&P GSCI Agriculture (SPGSAG). Retrieved May 25, 2022 from S&P Global.